Pliant - Company Reimbursement

︎︎︎ About the project:

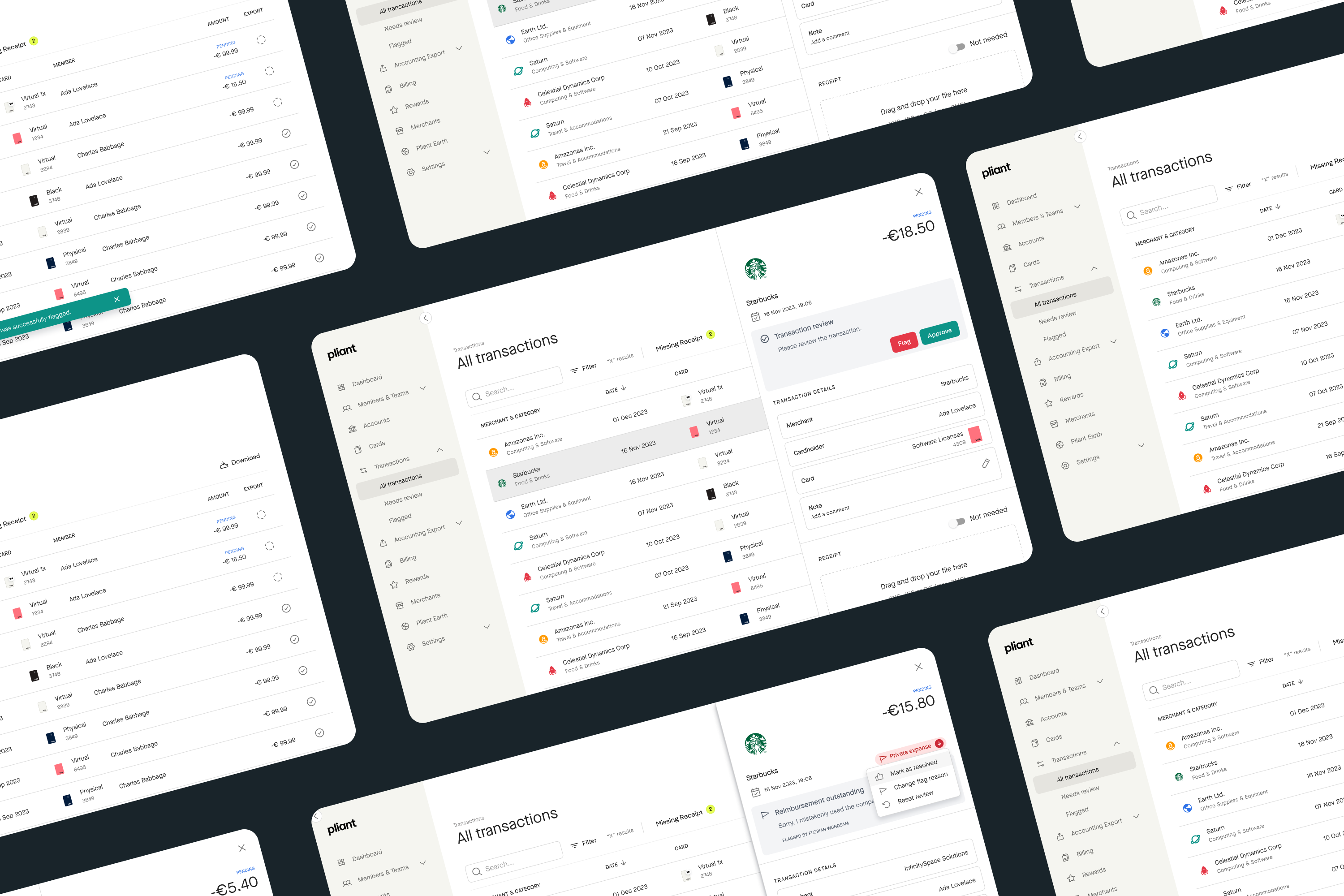

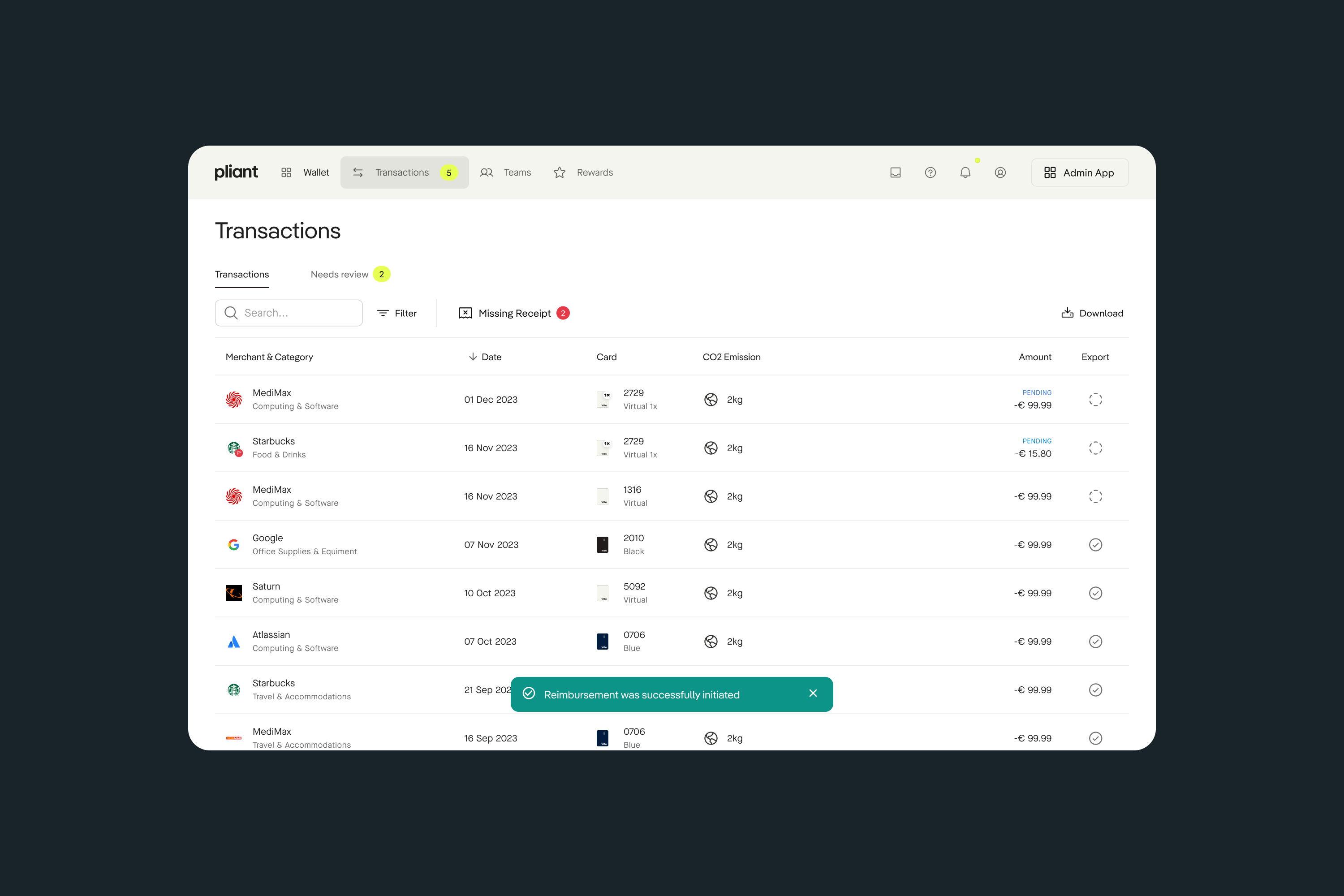

Managing company credit cards can be challenging, especially when employees accidentally use them for personal expenses. To help with this, we expanded the existing Transaction Review module — which allows admins to define which transactions require review based on rules like team assignments — by introducing a new feature: Company Reimbursements.

This new capability lets both admins and cardholders manually flag specific transactions that fall outside company policy, making it easier for employees to reimburse the company for personal charges. The result is a more flexible and transparent review process that gives finance teams greater control.

︎︎︎ Product Designer: Bruna Hirano

︎︎︎ The challege: Introduce Company Reimbursements feature

︎︎︎ Tools: Figma

︎︎︎ Year: 2024

Context

What is Pliant?

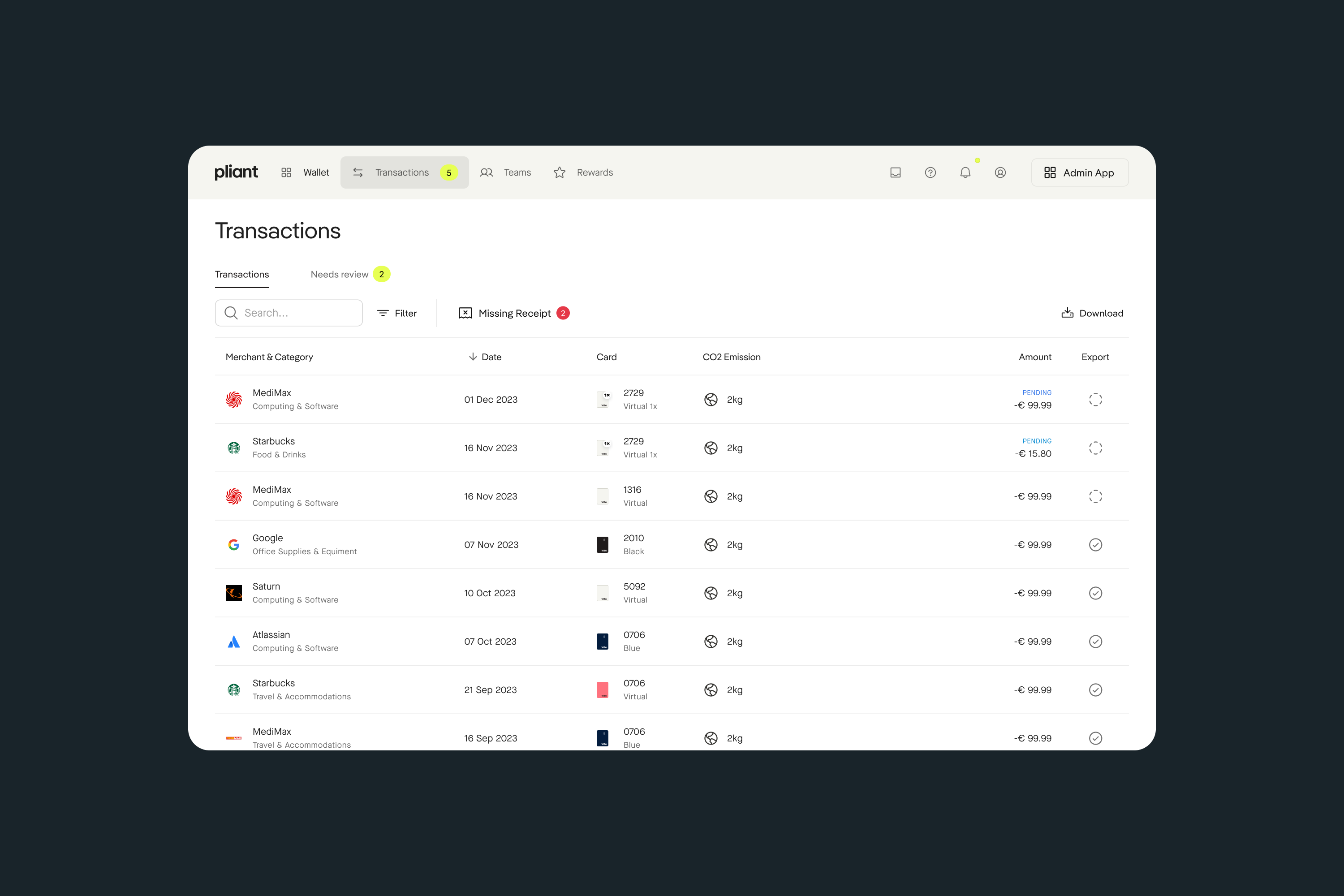

Pliant is a corporate credit card platform that simplifies business payment processes. It offers solutions like Payment Apps, Pro API, and Cards-as-a-Service (CaaS) to meet different organizational needs. Key features include real-time transaction tracking, customizable spending controls, receipt management, and easy integration with financial systems. Pliant provides both virtual and physical Visa credit cards with high limits and competitive cashback offers.

Problem statement

Organizations struggle with managing private expenses mistakenly charged to company cards. These challenges include:

- Accidental private charges: Employees may unintentionally use corporate cards for personal expenses, resulting in a complex reimbursement process.

- Receipt tracking difficulties: Admins often chase employees for missing receipts, leading to compliance issues and additional workload.

- Policy enforcement: Companies need better tools to handle out-of-policy transactions without complex manual intervention.

The goal was to create a structured solution that simplifies reimbursements, allowing employees to take responsibility for their private transactions with minimal friction.

Research & Implementation

︎︎︎ Understanding User Needs

To build an efficient reimbursement system, we gathered insights from finance teams and employees to understand their pain points. Key findings included:

- Users wanted a self-service solution to mark private transactions and reimburse them directly.

- Admins required visibility and control over flagged transactions.

- The system needed to be seamlessly integrated into existing workflows to ensure adoption. In our case, the Transaction Review feature was already in place. We simply added the option to include a flag reason to the transaction. If the reason is marked as a private expense, the employee can reimburse it directly through our platform.

︎︎︎ Phase 1: Manual Initiation of Reimbursements

In the first phase, we introduced:

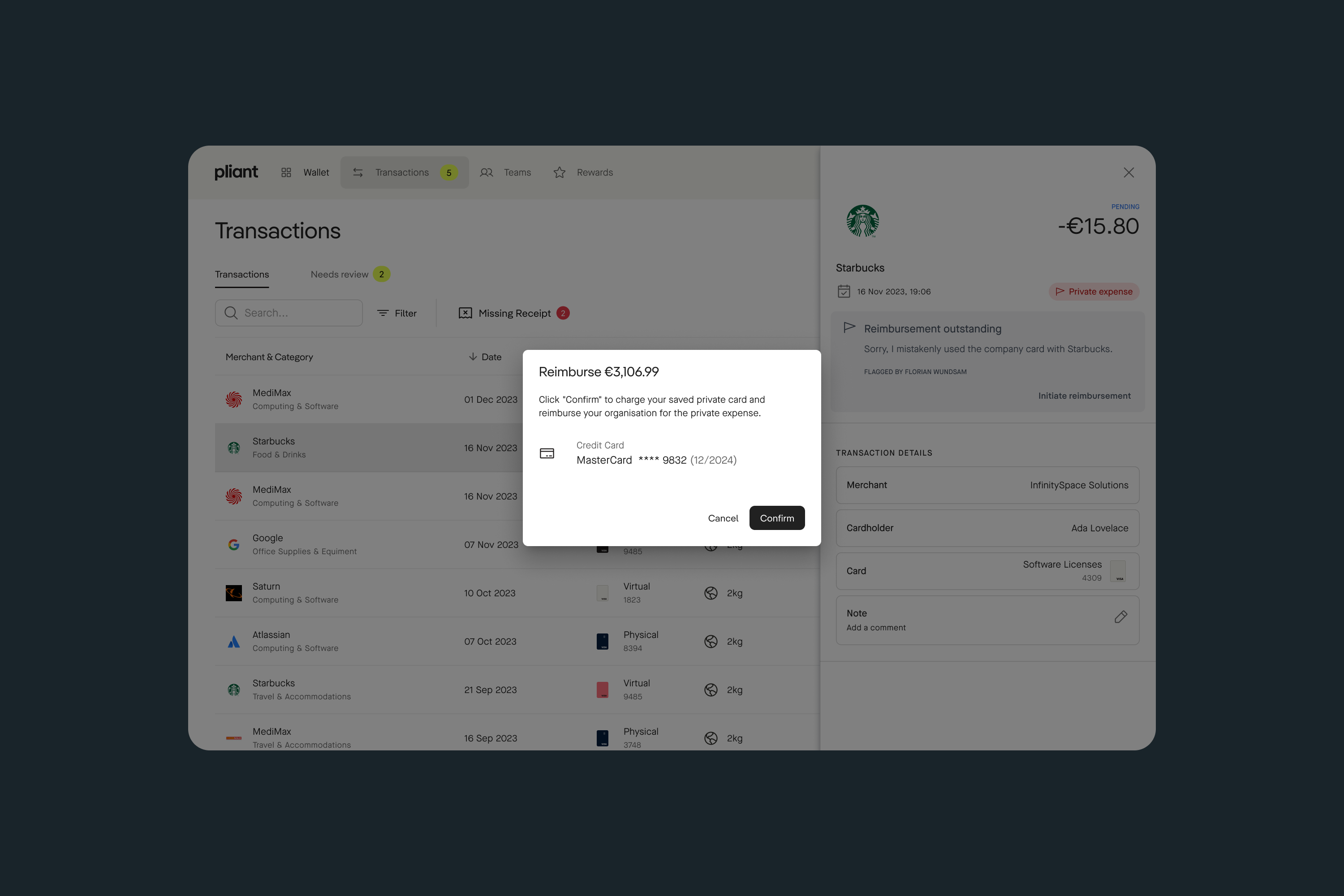

- The ability for employees to submit personal payment cards via the Cardholder app.

- A new “Private Expense” status for transactions, enabling clear categorization.

- An intuitive reimbursement flow, allowing employees to initiate payments back to the company with ease.

- Admin visibility to track reimbursement statuses and mark expenses as resolved.

User flows

︎︎︎ Flagging Transactions as Private Expenses

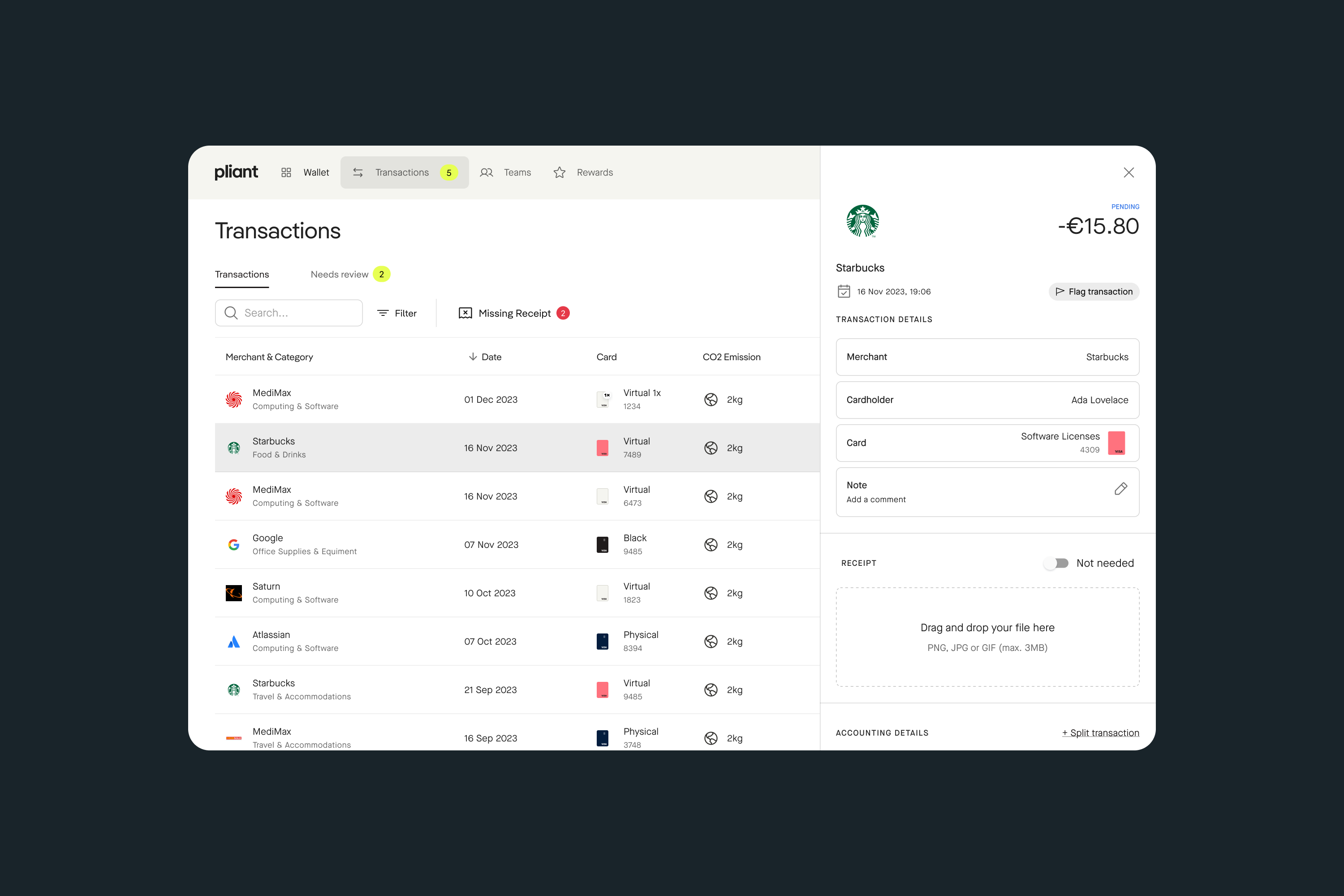

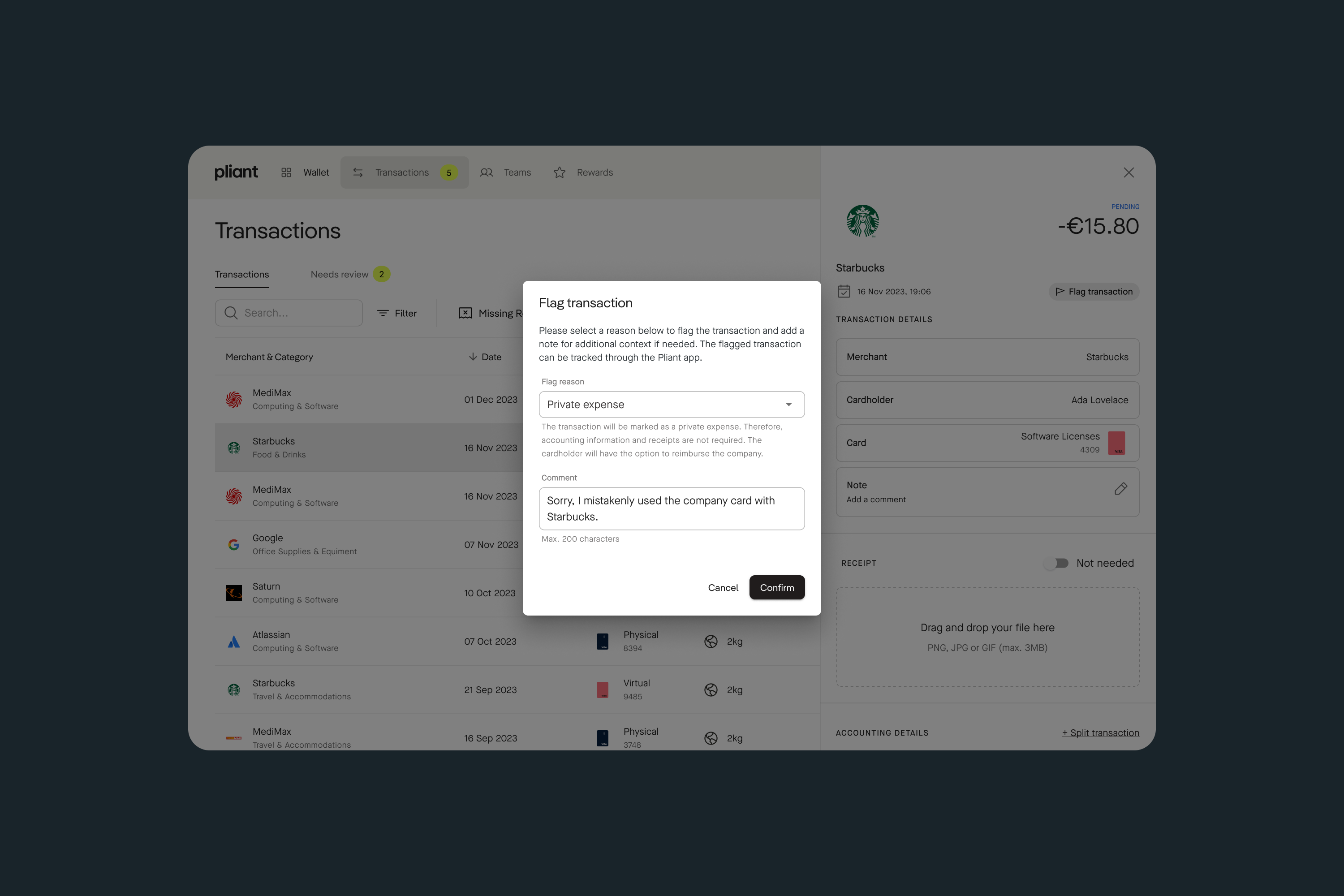

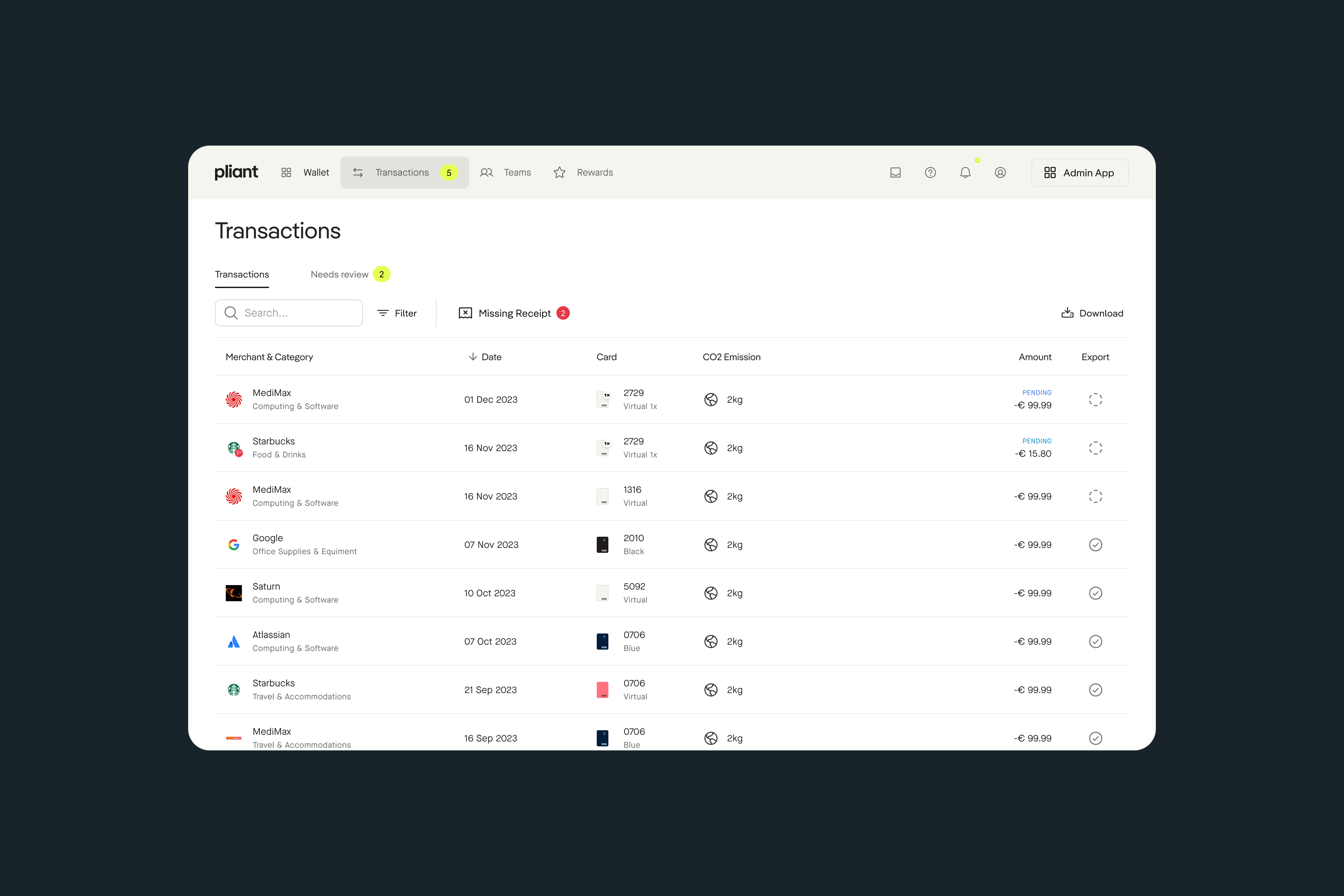

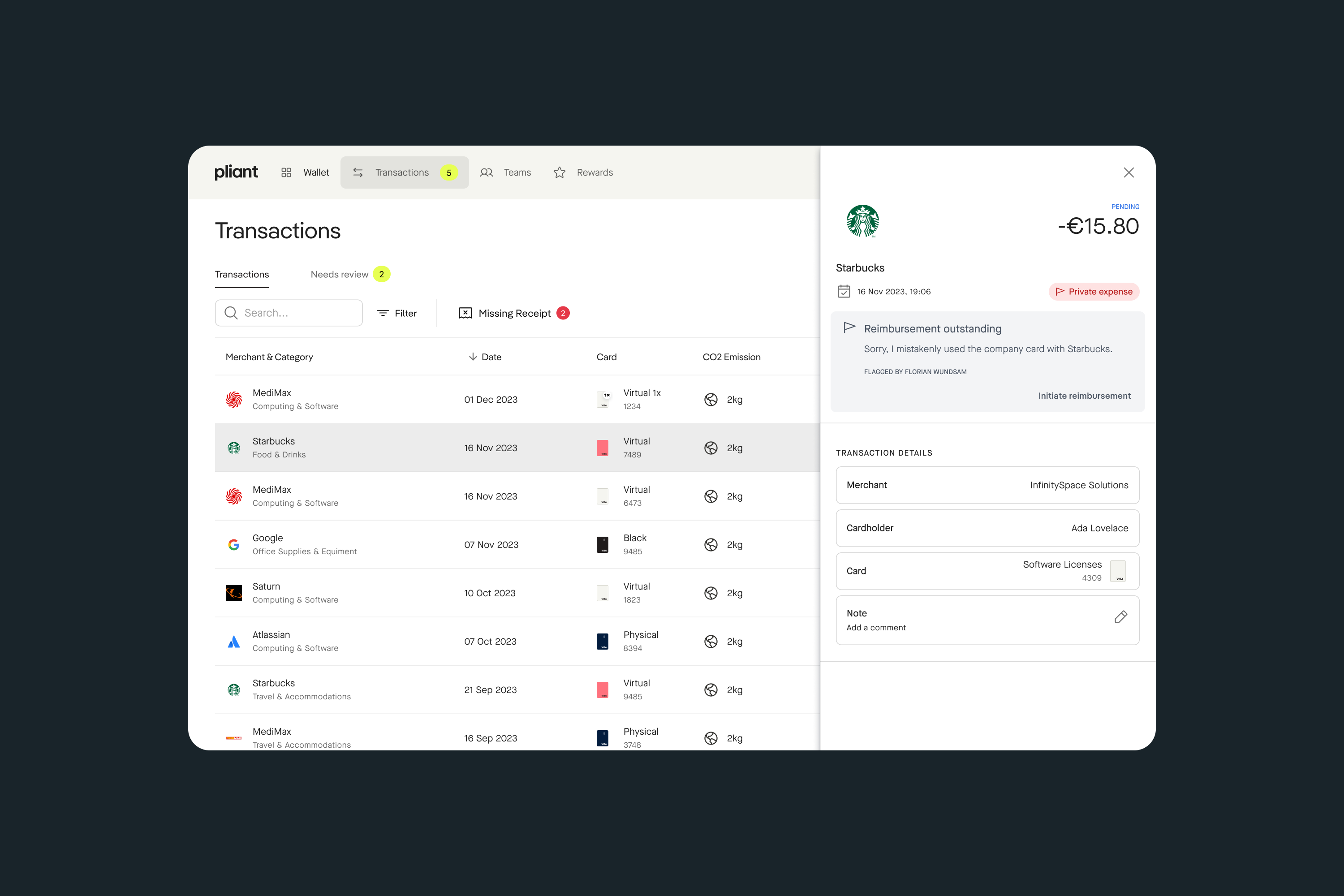

Employees can easily flag a transaction as a private expense. For example, if an employee accidentally uses their company card to pay for a Uber Eats delivery, they can simply open the Cardholder app, navigate to Transactions, find the relevant transaction, and mark it as a Private Expense. They also have the option to add a note explaining the mistake to their employer, ensuring transparency and accountability.

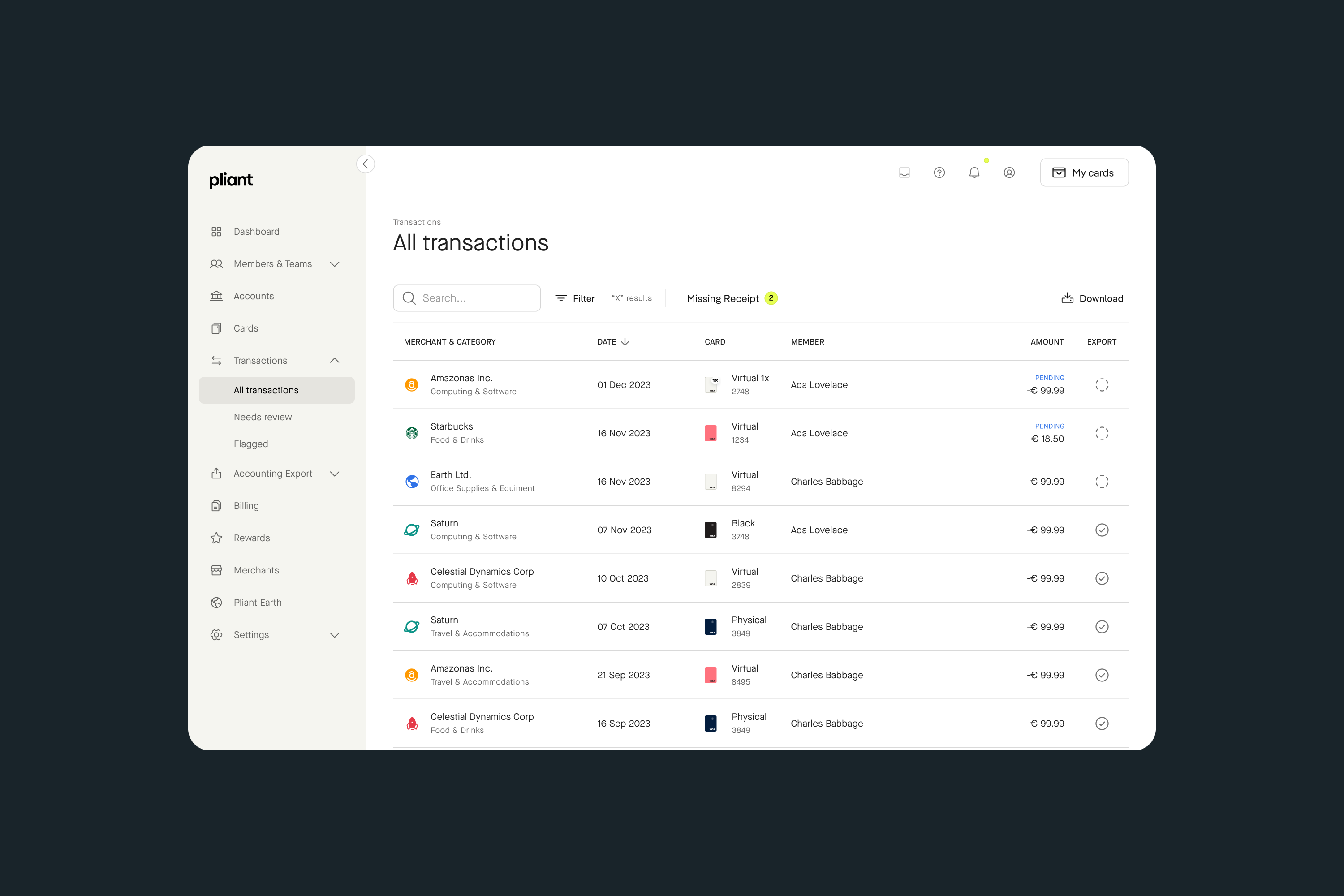

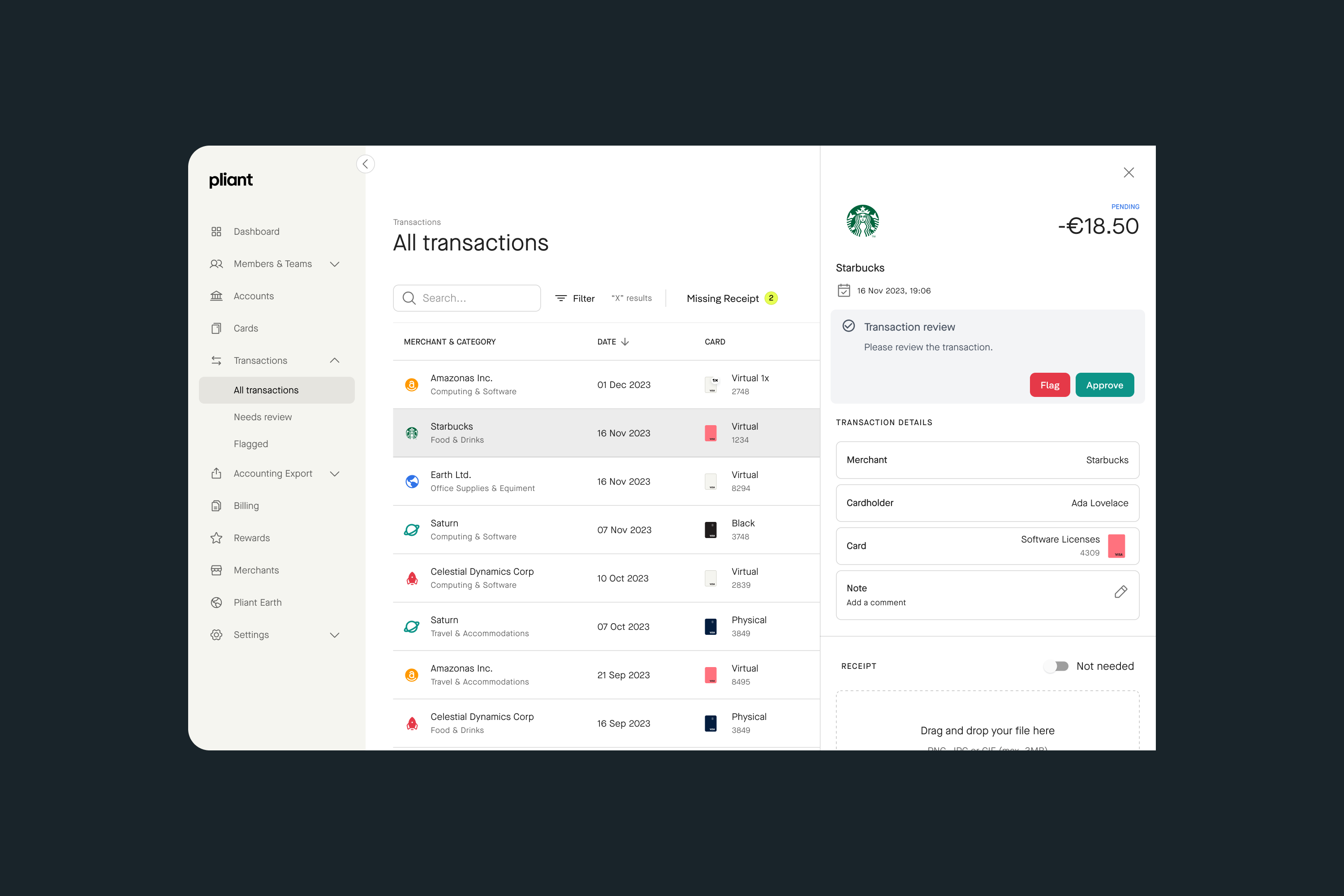

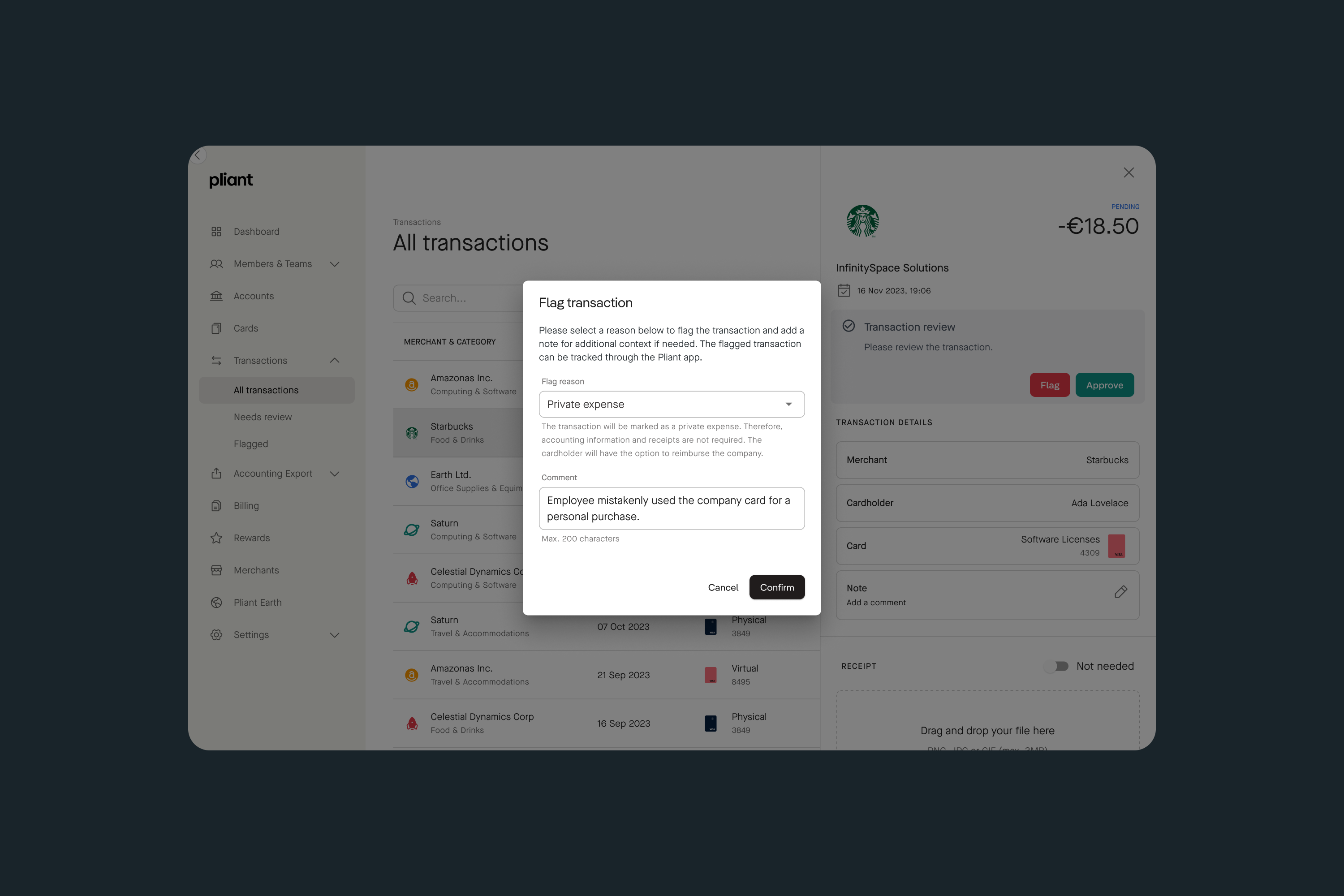

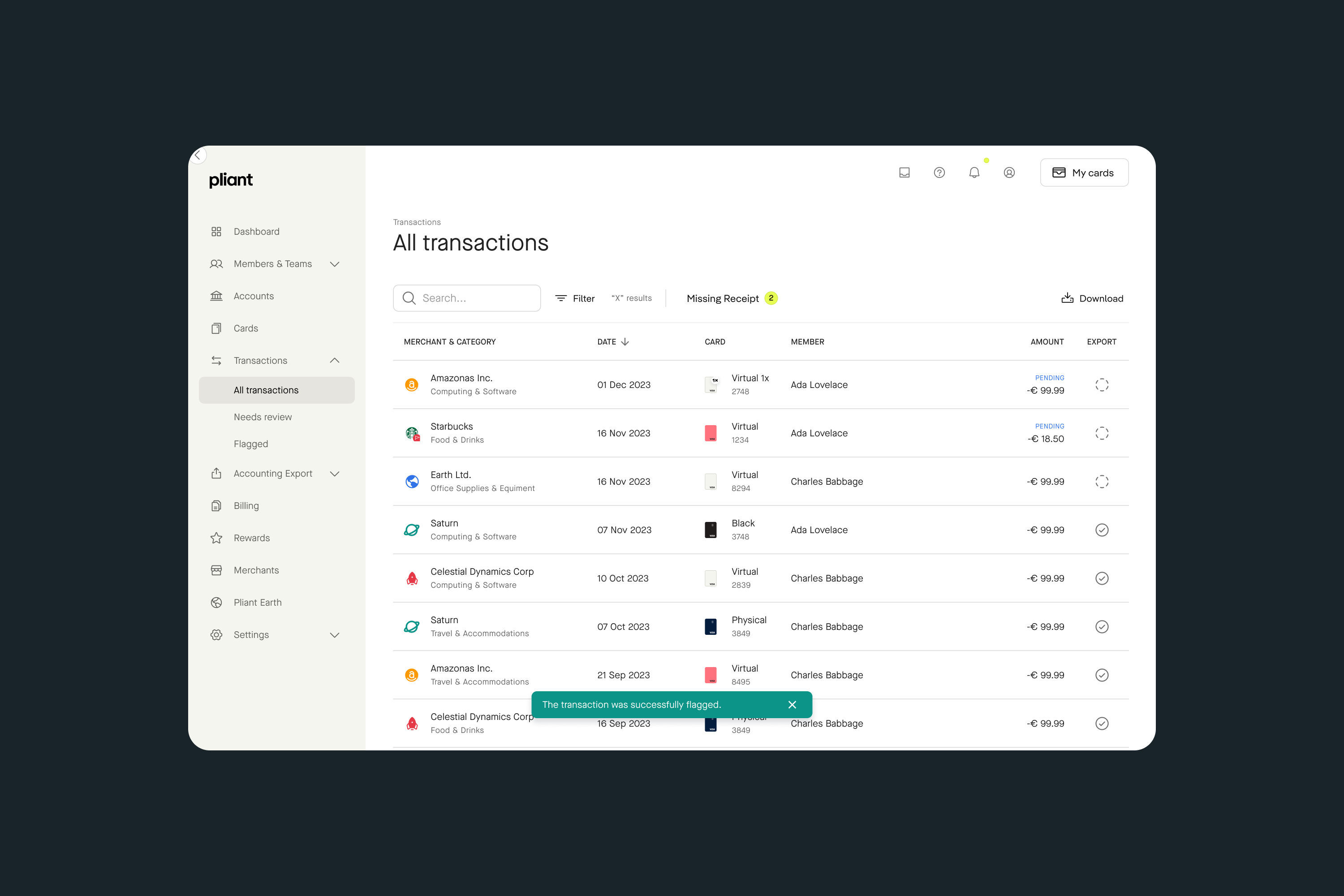

On the other hand, if you are the Admin of the company, you can also flag an employee’s transaction as a private expense. By simply going to the Admin app, navigating to Transactions, and selecting the relevant transaction, you can mark it as a Private Expense and send a note to the employee. This prompts them to initiate the reimbursement through the Pliant platform, ensuring efficient handling of private transactions.

The phase 1 ensures that employees can manage personal expenses efficiently while setting the groundwork for future automation.

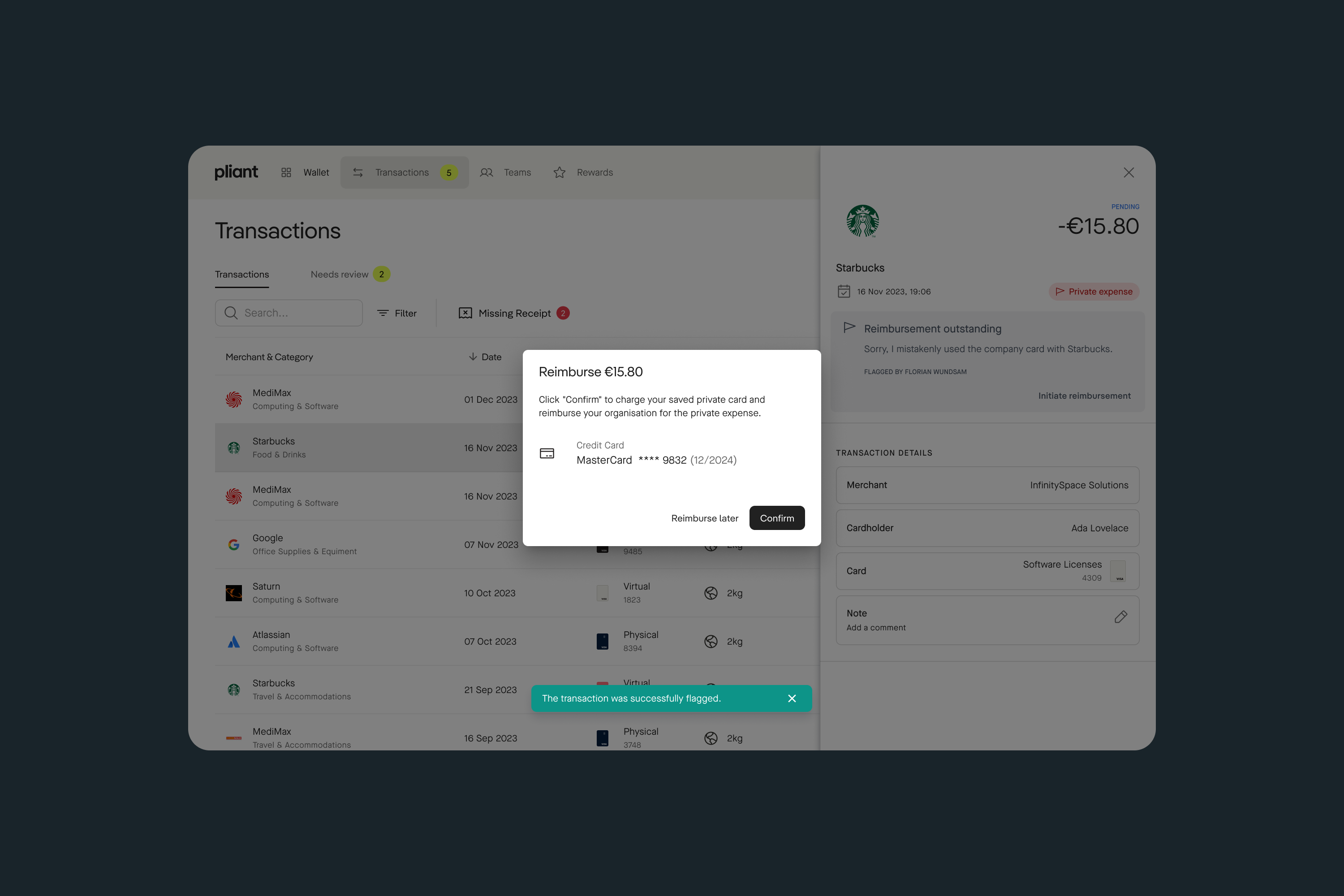

︎︎︎ Initiating Reimbursements

As an employee, if you didn’t initiate the reimbursement right after flagging the transaction, no problem — you can do it anytime later by selecting the transaction in the Pliant app and clicking “Initiate Reimbursement.” If your personal card is already added, the payment will go directly to the company, otherwise, you’ll be prompted to add it.

Conclusion

The successful implementation of Phase 1 of Company Reimbursements has provided employees and administrators with a easy way to handle private expenses. By introducing manual reimbursements, we have reduced the administrative workload and set up a solid foundation for future improvements.Looking ahead, we plan to introduce further automation and policy-driven features to enhance efficiency and control. These upcoming improvements will continue to refine the experience, making financial management even more seamless for organizations.

This project demonstrates our commitment to user-centered design, strategic implementation, and continuous innovation in corporate expense management.